When it comes to market capitalization, the most valuable asset in the world is gold, with a staggering market cap of $12.732 trillion1. Gold has maintained its value through market upheavals and is often considered a hedge against inflation because it retains its value even when the buying power of currency decreases.

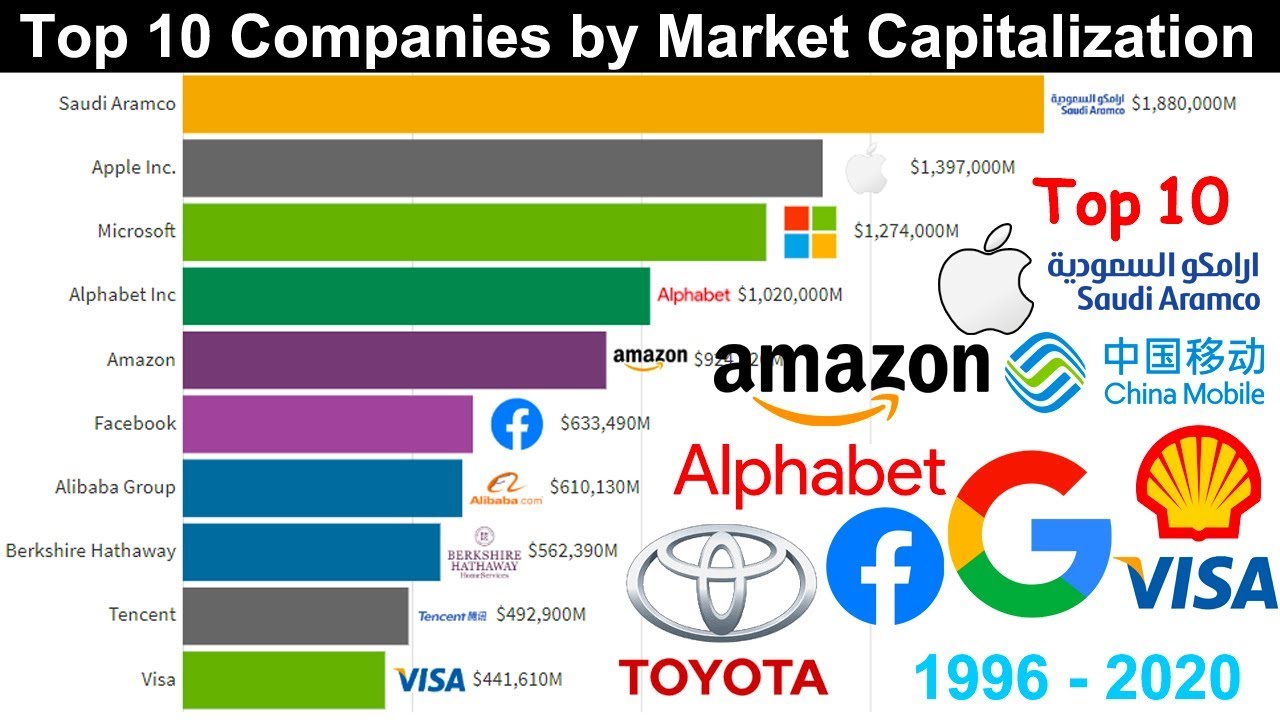

This precious metal is also a fantastic asset to diversify a portfolio, as its value tends to increase when stock and bond values fall, and vice versa.Gold’s market value is influenced by factors such as the rate of mining, jewelry demand, federal reserves, the value of currency, and market volatility1. Its high market cap reflects its historical significance and continued relevance in the global economy.In comparison, the top companies by market cap include Apple, Saudi Aramco, Microsoft, and other large corporations.

However, their market caps are significantly lower than that of gold. For instance, Apple has a market cap of $2.167 trillion, while Saudi Aramco is valued at $1.887 trillion1.Gold’s market cap is influenced by various factors, including the rate of mining, jewelry demand, federal reserves, the value of currency, and market volatility. Its high market cap reflects its historical significance and continued relevance in the global economy.

It’s important to note that market cap is a measure of a company’s total size and provides a sense of just how valuable it is despite a vast diversification of ownership. Companies are often described as mega-cap, large-cap, mid-cap, small-cap, or micro-cap, depending on their market value1.In conclusion, gold is the most valuable asset by market cap, with a market value of $12.732 trillion, significantly higher than that of the largest companies in the world. Its historical significance, stability, and ability to diversify a portfolio make it a valuable asset in the global economy.